Resources

Unlocking the Potential of Tokinvest

Tokinvest is a digital investment platform that enables users to invest in tokenized assets such as real estate, commodities, and digital securities. By leveraging blockchain technology, Tokinvest simplifies access to diversified, global investment opportunities.

Introduction to Tokinvest

Tokinvest is rapidly gaining attention in the fintech and blockchain sectors for its innovative approach to digital asset investment. As the global economy leans more into decentralization and digitalization, platforms like Tokinvest are making it easier for everyday investors to tap into markets that were once restricted to large institutions.

The idea behind Tokinvest is to tokenize real-world and digital assets, offering fractional ownership and transparency through blockchain. Whether you’re a seasoned investor or a newcomer exploring tokenized investments, understanding Tokinvest’s role in the evolving financial ecosystem is essential.

How Tokinvest Works

Tokinvest makes it straightforward to diversify your portfolio with tokenized assets. Here’s a breakdown of how the platform typically works:

1. Account Creation

Users sign up on the Tokinvest platform by providing basic personal details and verifying their identity in compliance with KYC regulations.

2. Wallet Integration

Once verified, users can link a digital wallet or create one on Tokinvest to securely manage tokenized assets and perform transactions.

3. Asset Selection

Browse through a variety of investment options — real estate tokens, security tokens, digital commodities, and more. Tokinvest provides detailed descriptions and expected ROI for each asset.

4. Investment Execution

Select the asset and decide on the amount you wish to invest. The investment is made in the form of digital tokens representing your ownership stake.

5. Portfolio Monitoring

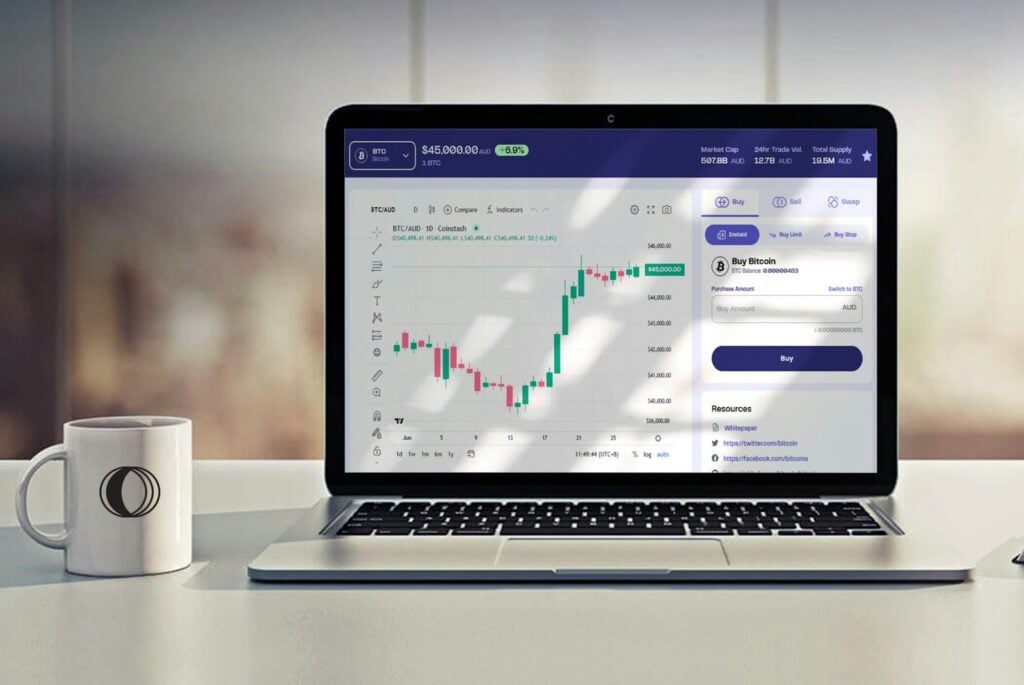

Track your investments in real-time through the Tokinvest dashboard, which includes analytics, earnings updates, and market trends.

6. Exit Strategy or Token Trading

Depending on the asset type, users can either hold their tokens for returns or trade them in secondary markets supported by the Tokinvest platform.

Pros and Cons of Using Tokinvest

| Pros | Cons |

|---|---|

| Easy access to diverse assets | Still subject to market volatility |

| Transparent and secure | Limited availability in some regions |

| Fractional investment | Regulatory uncertainty in some countries |

| Low barrier to entry | Requires digital wallet knowledge |

Key Features of Tokinvest

Tokenized Asset Variety

Tokinvest provides access to a broad range of assets, including:

- Real estate developments

- Renewable energy projects

- Equity tokens for startups

- Gold and precious metal tokens

This diversification helps investors spread their risk.

Regulatory Compliance

Tokinvest works within a framework of global compliance standards such as AML (Anti-Money Laundering) and KYC (Know Your Customer), providing a layer of security and legitimacy.

Blockchain-Powered Security

All transactions on Tokinvest are recorded on a public or permissioned blockchain, ensuring transparency, traceability, and fraud resistance.

Secondary Market Liquidity

One of the platform’s attractive features is the secondary trading option for certain tokens, giving users the flexibility to exit early if needed.

Common Mistakes to Avoid on Tokinvest

- Ignoring Token Utility and Terms

Many new users invest without understanding what their tokens represent. Always read the asset’s legal structure and associated rights. - Overlooking Fees

Some assets may involve administrative or management fees. Always check the fine print. - Misjudging Risk Level

Tokenized assets can still be volatile. Avoid investing more than you can afford to lose. - Neglecting Wallet Security

Failure to properly secure your digital wallet can lead to loss of funds. Use hardware wallets or robust authentication methods.

Checklist Before Investing on Tokinvest

- Completed KYC verification

- Linked a secure digital wallet

- Reviewed all investment documents

- Understood token rights and ROI projections

- Evaluated the associated risks

- Confirmed asset liquidity options

- Enabled 2FA for security

Tokinvest Compared to Other Token Platforms

| Platform | Asset Type Variety | KYC Required | Secondary Market | Blockchain Support |

|---|---|---|---|---|

| Tokinvest | High | Yes | Yes | Yes |

| RealT | Mainly real estate | Yes | Limited | Yes |

| Securitize | Corporate securities | Yes | Yes | Yes |

| Tokeny | Enterprise-grade | Yes | No | Yes |

Why Tokinvest Is Gaining Popularity

Tokinvest’s rise in popularity can be attributed to its user-centric design and global accessibility. Investors from multiple regions can participate in projects that were traditionally restricted to high-net-worth individuals or institutional investors. By simplifying the process through tokenization and blockchain, Tokinvest offers a democratized investment model.

Additionally, the growing awareness of decentralized finance (DeFi) and alternative investment options further propels Tokinvest’s visibility in the financial ecosystem. Reports from sources like Forbes confirm the increasing role of tokenized assets in reshaping finance.

FAQs About Tokinvest

1. Is Tokinvest safe to use?

Tokinvest follows strict KYC and AML guidelines and uses blockchain technology to provide secure, transparent transactions. However, as with any investment platform, risks are inherent.

2. Can I use fiat currency on Tokinvest?

Most assets require investment in cryptocurrency, but some listings may support fiat via third-party exchanges or integrated payment partners.

3. What kind of returns can I expect?

Returns vary by asset type. Real estate tokens might offer 5-10% annually, while startup equity tokens are more volatile with higher potential rewards — and risks.

4. Is Tokinvest available globally?

While Tokinvest aims for global access, certain jurisdictions may have restrictions due to local financial regulations. Always check the platform’s availability in your region.

5. How liquid are the investments on Tokinvest?

Liquidity depends on the specific asset. Some have active secondary markets, while others are intended for long-term holding.

6. Are Tokinvest returns taxed?

Yes, returns from Tokinvest may be subject to capital gains or other applicable taxes depending on your country. Consult with a tax advisor for specifics.

Expert Opinions and Trends

According to Cointelegraph, tokenized assets are one of the fastest-growing sectors in crypto and blockchain. Tokinvest’s strategy to combine accessibility, security, and real-world asset backing aligns with these industry trends.

The World Economic Forum has also emphasized that by tokenizing real-world assets, platforms can unlock over $24 trillion in assets previously deemed illiquid.

Final Thoughts on Tokinvest

Tokinvest is a forward-thinking platform designed to bring transparency, accessibility, and efficiency to the investment world. Through the use of blockchain technology, it opens doors for investors to engage with assets once out of reach, while also providing tools for managing and trading those investments seamlessly.

By focusing on user security, regulatory compliance, and a wide variety of tokenized assets, Tokinvest represents a solid entry point into the evolving world of digital finance. However, as with all financial tools, thorough research and careful planning are key to successful investing.

-

Resources4 years ago

Resources4 years agoWhy Companies Must Adopt Digital Documents

-

Resources3 years ago

Resources3 years agoA Guide to Pickleball: The Latest, Greatest Sport You Might Not Know, But Should!

-

Resources7 months ago

Resources7 months ago50 Best AI Free Tools in 2025 (Tried & Tested)

-

Guides2 years ago

Guides2 years agoGuest Posts: Everything You Should Know About Publishing It