Resources

Crypto Loans Explained: Unlock Instant Liquidity

Unlock instant liquidity with crypto loans at Omnilender.org. Access funds without selling your assets, even with bad credit. No credit checks required!

Understanding the Basics of Crypto Loans

Crypto loans are transforming the financial landscape. They offer a way to access cash without selling your digital assets. This innovative approach allows you to leverage your cryptocurrency holdings as collateral.

Platforms like Omnilender.org make it easy to apply for low-interest crypto loans. You can unlock instant liquidity while keeping your portfolio intact.

These loans are accessible to a wide audience, even those with bad credit. No credit check is required, making them an attractive option for many.

Crypto loans can be a lifeline in emergencies, providing cash without liquidation. They also offer a strategic way to manage your investments.

Understanding the basics of crypto loans is crucial. This guide will help you navigate the world of crypto lending with confidence.

What Are Crypto Loans?

Crypto loans let you use digital assets as collateral for cash. These assets, like Bitcoin, remain in your account, and you avoid selling them.

When a borrower needs liquidity, a crypto loan can be a practical solution. You receive funds without losing potential gains from holding your crypto.

Platforms facilitating these loans, such as Omnilender.org, provide various options. They offer low-interest rates and flexible terms to suit different needs.

Crypto loans are accessible to many because they often require no credit checks. This is appealing for people with less-than-perfect credit scores.

Consider the main features of crypto loans:

- Collateral is digital assets like Bitcoin or Ethereum.

- No need to sell assets, preserving your portfolio.

- Quick access to funds compared to traditional loans.

- Often, no credit checks are required.

Crypto loans can serve multiple purposes. They are useful for emergency expenses, investment opportunities, or consolidating debt.

Overall, crypto loans provide a strategic financial tool. Understanding how they work can unlock potential benefits for digital asset holders.

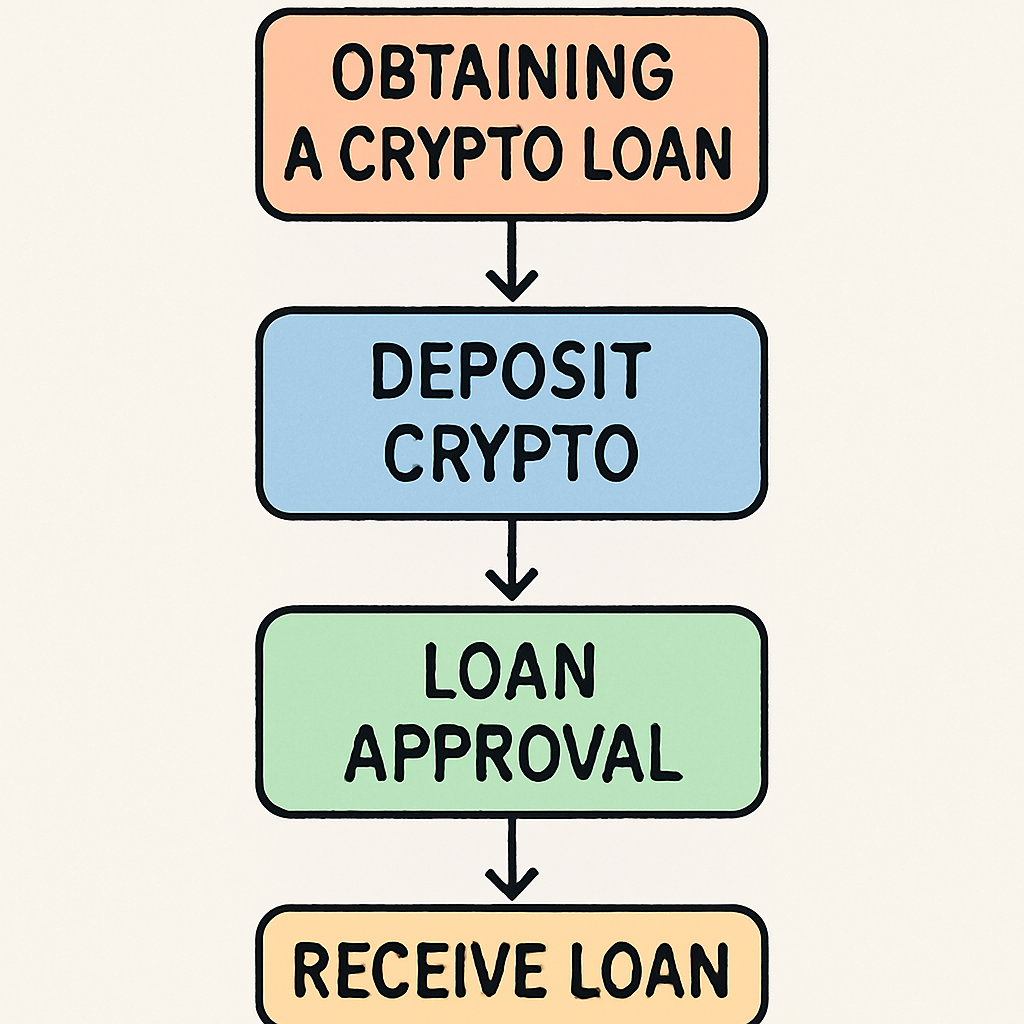

How Do Crypto Loans Work?

Crypto loans involve a straightforward process using digital assets as collateral. This process allows you to access liquidity without selling your crypto.

To start, you choose a lending platform that suits your needs. After you register, you’ll deposit your chosen cryptocurrency into the platform.

Once collateral is secured, the lender provides a loan based on the asset’s value. Loan amounts vary, usually reflecting a percentage of your collateral’s worth.

Lenders use the collateral as security, reducing their risk. This setup enables them to offer loans with favorable terms, like low-interest rates.

Key steps in the crypto loan process include:

- Choosing a reputable crypto lending platform.

- Depositing digital assets as collateral.

- Receiving a loan amount based on collateral value.

- Paying back the loan to reclaim your digital assets.

These steps are automated with some platforms, using smart contracts. This technology adds transparency and security to the transaction.

Understanding how crypto loans work can help you make informed financial decisions. These loans offer a flexible, quick financing option without liquidating your portfolio.

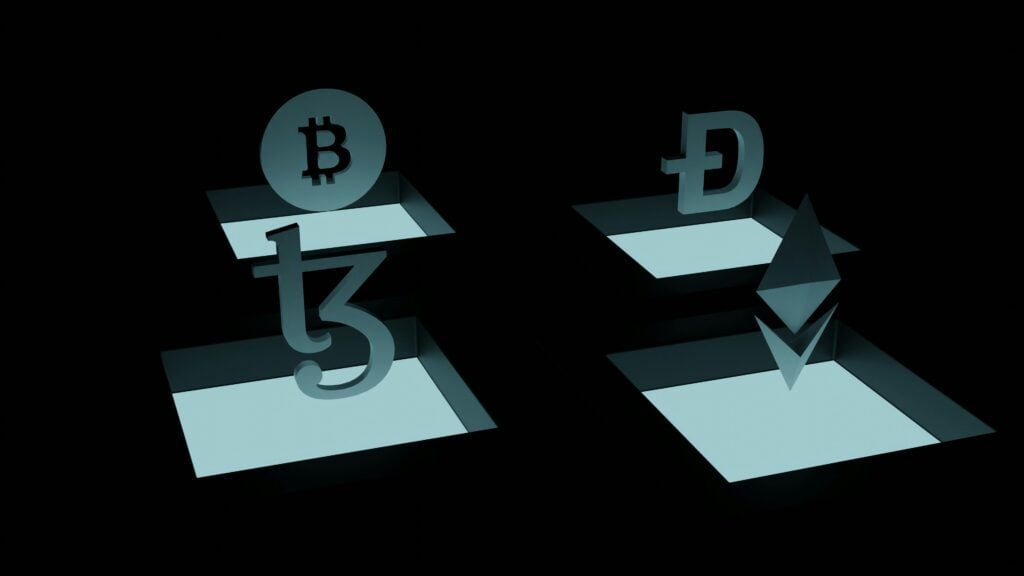

Types of Crypto Loans: Centralized vs. Decentralized (DeFi Lending)

Crypto loans come in two main varieties: centralized and decentralized. Understanding the difference can guide you in choosing the right option.

Centralized platforms operate like traditional banks. They manage all aspects of the loan, from custody of assets to interest rates. Centralized lenders often have established reputations, offering added trust and security.

Decentralized Finance (DeFi) platforms, on the other hand, use blockchain technology. These platforms facilitate peer-to-peer lending via smart contracts. The system is automated, with no central authority overseeing transactions.

The choice between centralized and decentralized loans often depends on risk tolerance and preferences. DeFi lending offers greater transparency and potentially lower fees. However, it comes with higher risks due to less regulation.

Here’s a quick comparison list:

- Centralized Platforms: Managed by companies, more security, less control for borrowers.

- DeFi Platforms: Peer-to-peer, fully automated, high transparency, higher risk.

The choice ultimately hinges on personal needs and comfort with technology. Exploring both options can reveal which best fits your financial goals.

Key Benefits of Crypto Loans

Crypto loans offer a multitude of advantages for those willing to explore this innovative financial solution. Key benefits make them particularly attractive to digital asset holders.

One of the primary benefits is liquidity. Crypto loans allow you to access cash without selling your digital assets. This preserves your investment and avoids triggering any potential capital gains tax.

The interest rates on crypto loans can be quite competitive. Many platforms, such as Omnilender.org, offer low-interest options. This makes it easier to manage repayments and makes borrowing more affordable.

Another advantage is speed and convenience. The application process is typically faster and simpler than traditional loan options. In many cases, loans can be approved and funds disbursed within hours.

A diverse range of options is available to borrowers. For those with bad credit, getting a loan without a credit check is possible. This inclusivity extends financial opportunities to a broader audience.

Here’s a summary of benefits:

- Liquidity Without Selling

- Competitive Interest Rates

- Fast Approval Process

- Inclusive Lending Options

These benefits highlight why crypto loans are growing in popularity and are worth considering for those who need quick financial solutions.

Risks and Considerations

While crypto loans offer distinct advantages, they come with inherent risks. It’s crucial to thoroughly understand these before proceeding.

One significant risk is market volatility. If cryptocurrency prices drop sharply, the value of your collateral might decrease. This could lead to a margin call where you’re required to provide additional collateral.

Another concern is the potential for liquidation. Should your collateral’s value drop below a certain threshold, the platform may liquidate your assets. This can result in unexpected losses.

Understanding platform security is also vital. The handling and storage of your digital assets should be top-notch to prevent theft or loss. Research the platform’s security measures diligently.

Fees and conditions can vary widely among platforms. Ensure you are clear on any hidden charges that may affect loan costs. This includes origination fees, maintenance fees, and potential penalties.

Key considerations include:

- Market Volatility

- Liquidation Risks

- Platform Security

- Fee Structures

Staying informed about these aspects will help make better borrowing decisions.

How to Get a Crypto Loan: Step-by-Step Guide

Getting a crypto loan is generally a straightforward process. Each step requires careful attention to detail for a seamless experience.

First, choose a reputable lending platform. Compare factors such as interest rates, security, and user reviews to make an informed choice.

Next, set up an account on the selected platform. This involves providing some basic personal information and verifying your identity.

Third, determine the amount you wish to borrow and the collateral you plan to use. Ensure your collateral meets the platform’s minimum requirements.

Following that, apply for the loan on the platform. This process might involve selecting loan terms, such as duration and interest rate preferences.

Once your application is approved, the funds are typically disbursed quickly. You may choose to receive them in cryptocurrency or convert them to fiat currency.

Lastly, ensure you keep up with repayment terms to avoid penalties. Timely payments will help maintain your assets and credit standing.

Steps to obtain a crypto loan:

- Select a lending platform.

- Create and verify your account.

- Determine the loan amount and collateral.

- Submit your loan application.

- Receive the loan.

- Fulfill repayment terms.

By following these steps, you can access the liquidity you need without selling your cryptocurrency assets.

Crypto Loans Without Collateral and for Bad Credit

Crypto loans without collateral offer a unique solution for borrowers. They enable access to funds without needing to pledge digital assets.

These loans cater to individuals with bad credit. Traditional lending often relies heavily on credit scores, limiting options for many.

In contrast, some crypto lenders do not consider credit scores. This opens the door for a wider range of borrowers.

However, such loans may come with higher interest rates. The absence of collateral increases the lender’s risk, often leading to steeper terms.

Key features of collateral-free crypto loans:

- No credit checks required

- Accessible to individuals with poor credit history

- Higher interest rates compared to collateralized loans

- Quick approvals and disbursements

Borrowers seeking these loans should compare multiple platforms. Choosing one with transparent fees and reliable security measures is vital.

Comparing Crypto Lending Platforms: What to Look For

When selecting a Crypto Lending Platform, several factors should guide your decision. Transparency in fees and terms is crucial to avoid unexpected costs.

Evaluate the interest rates offered by different platforms. Some platforms provide more competitive rates, which can save you money over time.

Security is paramount when dealing with digital assets. Ensure the platform uses robust encryption and has a solid reputation for protecting user data.

Look for these key features in a crypto lending platform:

- Transparent fee structures

- Competitive interest rates

- Strong security measures

- User-friendly interface

- Positive user reviews

Customer support is another critical factor. A responsive support team can resolve issues quickly, enhancing the user experience.

By considering these aspects, you can choose a platform that best meets your needs. A well-researched choice can lead to a more secure and rewarding lending experience.

Spotlight: Omnilender.org and Low Interest Crypto Loans

Omnilender.org is a prominent player in the crypto lending industry, offering competitive low-interest crypto loans. These loans provide liquidity without forcing you to sell your valuable digital assets.

One standout feature of Omnilender.org is its instant loan approval process. With no credit checks required, the platform makes loans accessible to a wider audience, including individuals with bad credit.

Omnilender.org emphasizes flexibility and transparency in its terms and conditions. Borrowers can take advantage of flexible repayment options, choosing to repay in either cryptocurrency or fiat currency.

Key advantages of using Omnilender.org include:

- Low-interest rates

- Instant loan approvals

- No credit checks

- Flexible repayment options

- Transparency in terms

By leveraging these features, Omnilender.org positions itself as a top choice for borrowers seeking hassle-free loans. Their platform allows investors to unlock cash while keeping their crypto portfolios intact.

Use Cases: Emergency Cash, Portfolio Management, and More

Crypto loans provide versatile solutions for a range of financial needs. Whether it’s covering unexpected expenses or managing your investment portfolio, these loans offer unique advantages.

For emergencies, crypto loans offer a quick way to secure cash without liquidating assets. This ensures your investment strategies remain intact during financial hiccups.

For portfolio management, these loans enable you to leverage digital assets. You can access cash for new investment opportunities without selling your current holdings.

Here are some potential use cases:

- Emergency cash solutions: Fast access to liquidity during financial crises.

- Portfolio diversification: Invest in new opportunities while retaining existing assets.

- Debt consolidation: Lower interest rates compared to traditional loans.

These flexible use cases make crypto loans an attractive option for both immediate and strategic financial planning.

Tax Implications and Legal Considerations

Crypto loans come with specific tax and legal complexities. It’s crucial to understand these before proceeding. Not all jurisdictions treat crypto loans the same way, which can impact your obligations.

Tax implications could involve capital gains. If your collateral appreciates or if you incur losses, tax consequences may follow.

Here are a few considerations:

- Interest payments: Might be tax-deductible in some regions.

- Capital gains tax: Selling collateral may trigger this tax.

- Regulations: Vary widely, so understanding local laws is key.

Legal considerations should not be overlooked. Using reputable platforms with clear policies helps ensure compliance and security. Consulting with a financial advisor can clarify uncertainties and help manage any potential liabilities.

Frequently Asked Questions About Crypto Loans

Many people have questions when considering a crypto loan. Here’s a quick overview of common concerns.

What are crypto loans? These loans let you borrow against your crypto without selling it.

A few frequent questions include:

- How fast can I get a loan?

- Are credit checks required?

- Which cryptocurrencies can be used as collateral?

Understanding the basics can help you decide if this lending method is right for you. It’s advisable to research specific lending platforms for more detailed information.

Conclusion: Is a Crypto Loan Right for You?

Deciding on aCrypto Loaninvolves weighing both benefits and risks. If you seek liquidity without losing your crypto, it can be a smart move.

Consider your financial goals and current market conditions. Evaluate if you can manage potential collateral fluctuations.

Lastly, thorough research of platforms and their terms is vital. A well-informed choice can maximize gains and minimize risks. Always assess if a crypto loan aligns with your financial strategy.

-

Resources4 years ago

Resources4 years agoWhy Companies Must Adopt Digital Documents

-

Resources3 years ago

Resources3 years agoA Guide to Pickleball: The Latest, Greatest Sport You Might Not Know, But Should!

-

Resources8 months ago

Resources8 months ago50 Best AI Free Tools in 2025 (Tried & Tested)

-

Guides2 years ago

Guides2 years agoGuest Posts: Everything You Should Know About Publishing It