Blogs

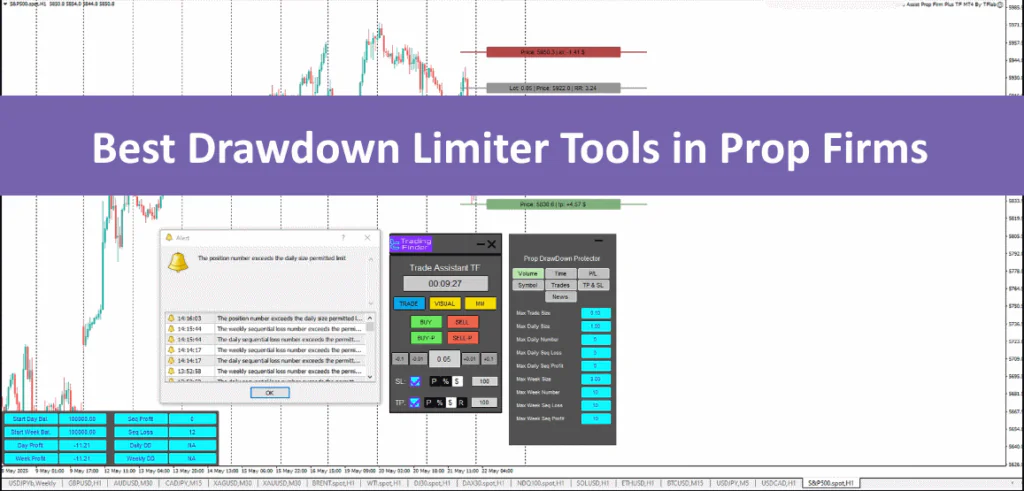

Explore the Best Drawdown Limiter Tools in Prop Firms

Statistics reveal that over 68% of failed prop firm challenges result from breaching drawdown limits rather than poor market predictions. With major firms like FTMO, MyForexFunds, and The Funded Trader imposing strict daily and total loss restrictions, traders must equip themselves with reliable tools for real-time monitoring and automated protection.

The market for trading risk management software is projected to grow by 12.4% annually until 2028, highlighting the rising need for precision risk control.

Explore the best drawdown management tools in prop firm trading

5 Essential Drawdown Prop Firm Protection Tools

These 5 advanced solutions are built to help traders stay within firm rules, prevent exceeding drawdown thresholds, and trade with greater confidence:

- The Prop Firm Capital Protection Expert

- Ultimate Drawdown Recovery EA

- UV Drawdown Reduction System MT5

- Prop Firm DrawDown Guard MT5

- Drawdown Guardian Pro

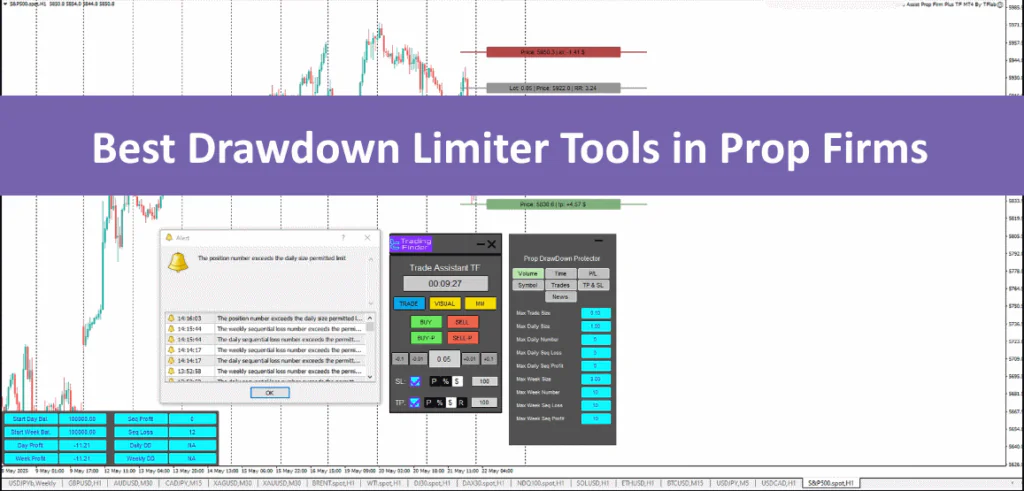

The Prop Firm Capital Protection Expert

Developed by TradingFinder and offered as a powerful expert advisor, this EA simplifies trade management for prop firm traders. It ensures precise control over open trades, improving compliance with drawdown rules while reducing manual workload.

Download links for MT4 and MT5:

- · Prop Firm Capital Protection Expert (MT4, MT5 Version)

Key Features:

- Automated management for all active positions: Trades are monitored and managed without constant trader intervention, ensuring consistency even during volatile market conditions;

- Flexible stop-loss, take-profit, and trailing stop settings: Adapt risk parameters based on market volatility and prop firm requirements;

- Partial close functionality: Take partial profits while keeping a portion of the trade active to capture extended moves;

- Break-even automation: Automatically moves stop-loss to breakeven after reaching a set profit level, eliminating risk on the trade;

- Customizable capital management rules: Set capital exposure limits tailored to specific prop firm challenge restrictions;

- MT5 compatibility: Works seamlessly with most MetaTrader 5 brokers, making it widely accessible for traders.

Prop Firm Capital Protection Expert with trade automation, break-even rules, partial close options, and custom capital limits

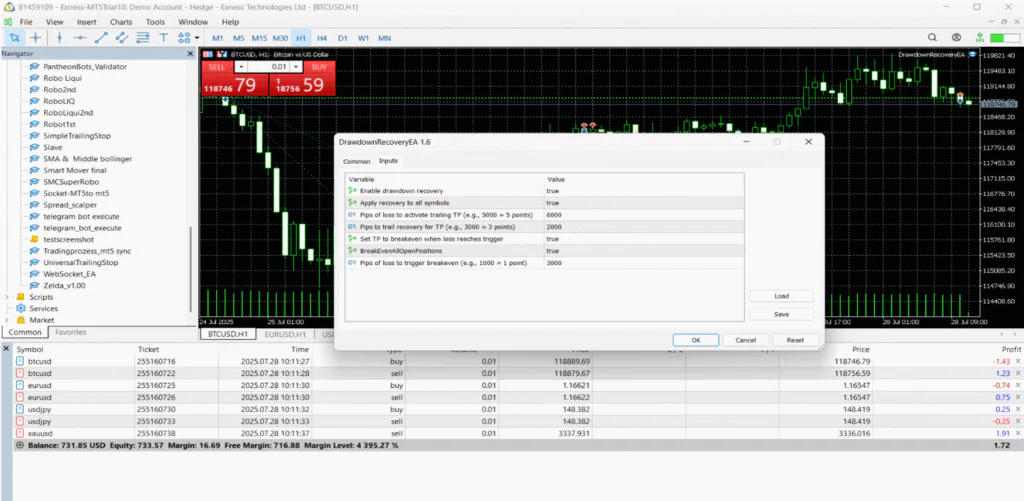

Ultimate Drawdown Recovery EA

Created by Freedom Uzochukwu Nnadi and priced at $39 USD (with a free demo), this EA specializes in recovering from drawdowns, exiting trades at strategic points, and securing profits. It’s designed for traders aiming to pass drawdown prop firm challenges without exceeding loss limits.

Key Features:

- Smart Drawdown Recovery Engine: Activates when trades hit set loss levels and dynamically adjusts TP;

- Multi-Symbol Recovery Mode: Works on all symbols or specific pairs;

- Break-Even Protection: Automatically sets TP to break-even during adverse market movements;

- Dynamic Trailing TP Adjustment: Adjusts TP intelligently to secure profits while limiting risk;

- Ultra-Flexible Configuration: Customize every protection feature to suit your trading strategy;

- Blazing Fast Execution: Optimized for Forex, Gold, crypto, and other markets.

Ultimate Drawdown Recovery EA by Freedom Uzochukwu Nnadi that activates recovery protocols at set loss thresholds and adjusts take-profit dynamically

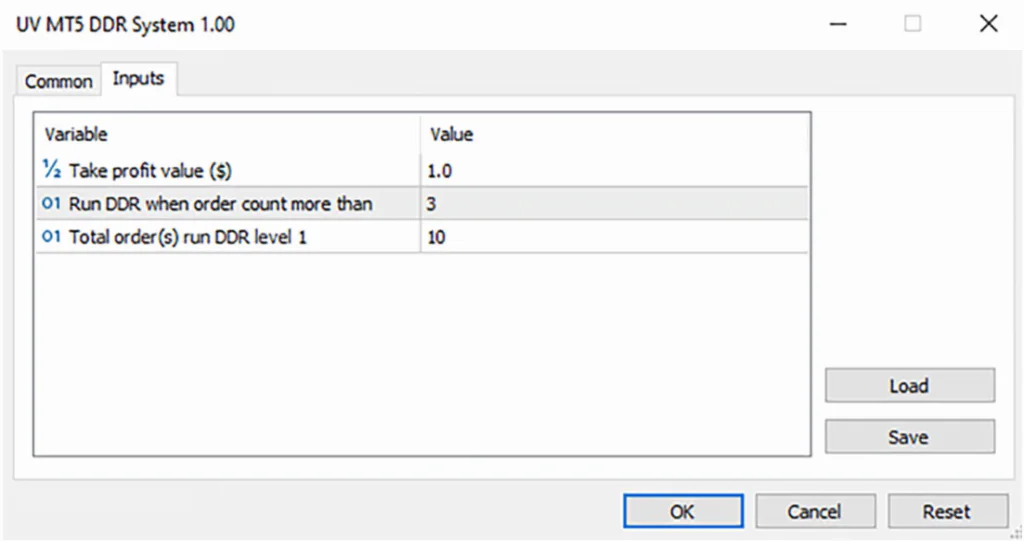

UV Drawdown Reduction System MT5

Developed by Banh Thanh Vi in May 2025 for $99 USD, this system minimizes losses without using stop-loss orders, making it especially useful for prop firm accounts.

Key Features:

- Reduces drawdown without SL: Actively manages positions to limit equity decline without relying on fixed stop-loss levels;

- Compatible with other EAs: Can run alongside existing expert advisors without conflict, enhancing overall trading strategies;

- Two operational modes for different trade sizes: Adjusts its logic based on small or large lot trading for optimized performance;

- Optimizes risk-to-reward ratio: Strategically adjusts trades to improve potential profits while minimizing exposure.

UV Drawdown Reduction System MT5 by Banh Thanh Vi, optimizing trades based on lot size without interfering with other EAs

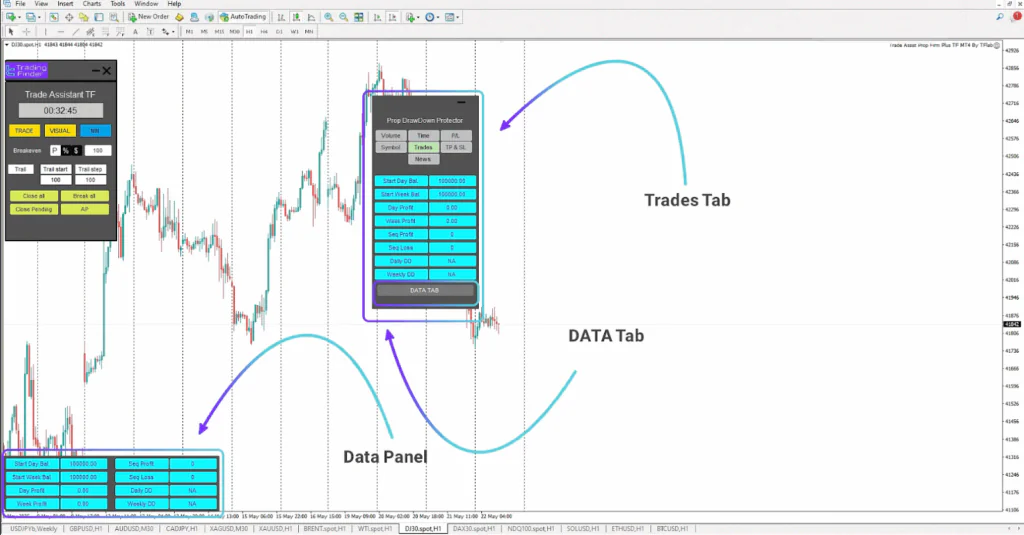

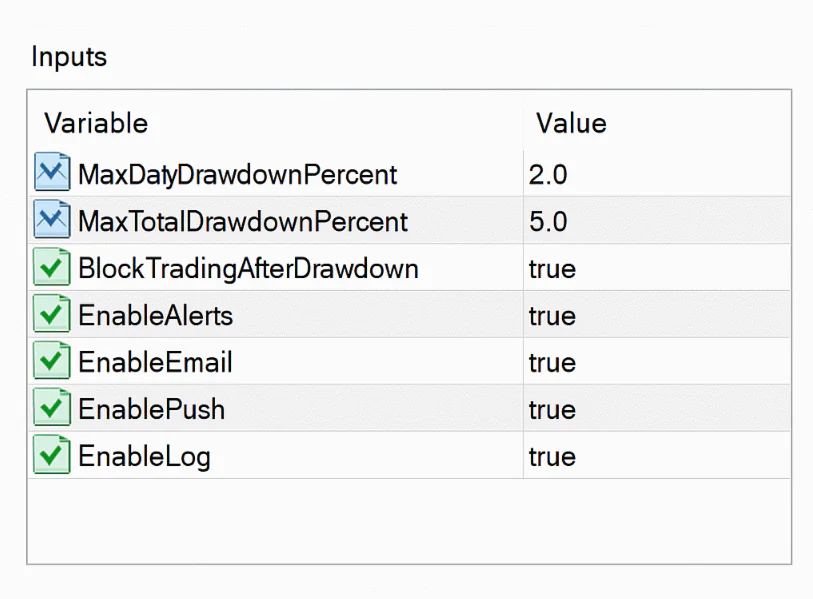

Prop Firm DrawDown Guard MT5

Built by Branko Balog in April 2025 for $49 USD, this EA enforces both daily and overall drawdown restrictions.

Key Features:

- Monitors daily and total equity drawdown: Continuously tracks both daily and overall account equity decline to ensure compliance with strict prop firm loss limits;

- Auto-closes positions upon limit breach: Instantly closes all open trades the moment set drawdown thresholds are exceeded, preventing further losses;

- Blocks new trades for the day: Automatically restricts trading activity for the rest of the day after hitting daily drawdown limits to maintain compliance;

- Sends alerts via multiple channels: Notifies the trader through various communication methods such as platform pop-ups, emails, or push notifications, allowing for immediate awareness and action.

Prop Firm DrawDown Guard MT5 by Branko Balog general configuration in panel

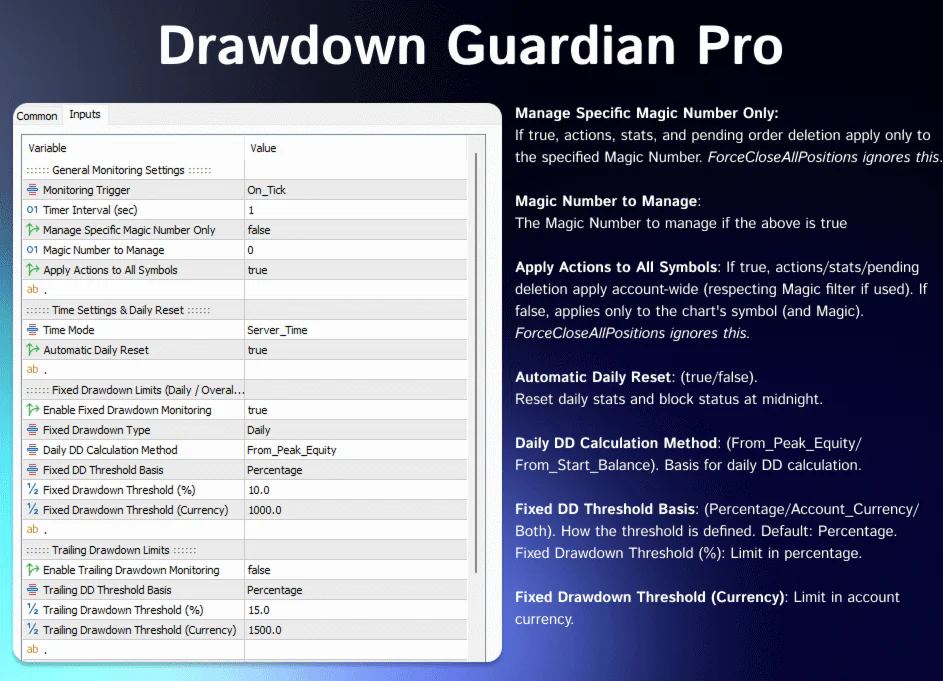

Drawdown Guardian Pro

Released by Artem Khakalo in April 2025 for $30 USD, this tool delivers detailed equity tracking and highly customizable safety settings.

Key Features:

- Monitors daily, total, and custom drawdown limits: Tracks not only standard daily and total equity declines but also custom thresholds set by the trader for enhanced flexibility;

- Configurable trade block and stop levels: Allows precise adjustment of when to halt trading or close positions entirely, tailored to your prop firm’s rules;

- Detailed visual and report tracking: Provides easy-to-read charts, logs, and equity reports to keep you informed about performance and risk management;

- Supports manual and automated trading: Works seamlessly with both discretionary manual trading and fully automated strategies for maximum versatility.

Drawdown Guardian Pro by Artem Khakalo with configurable stops and real-time performance reports for manual or automated trading

Conclusion

These 5 drawdown prop firm tools represent a critical safeguard for traders aiming to pass evaluations and maintain funded accounts. Industry statistics show that over 68% of prop firm account failures occur due to exceeding drawdown limits rather than making poor trade calls.

Whether you’re looking for detailed equity tracking, customizable recovery strategies, or instant protective actions, each of these tools brings a unique set of features that cater to different trading styles and prop firm requirements.

By integrating one or more of these tools into your strategy, you significantly improve your odds of long-term success, protect your capital, and free your focus for finding profitable opportunities rather than worrying about rule violations.

Sources: TradingFinder, MQL5

FAQs

What is drawdown in prop firm trading?

It’s the percentage decline from an account’s highest equity point, a key metric in passing evaluations.

Why do prop firms set drawdown rules?

To protect their capital and enforce consistent, disciplined trading behavior.

Are drawdown in prop firm tools broker-specific?

Most are designed for MetaTrader 5 and are compatible with common MQL5 brokers.

Can these tools guarantee challenge success?

No, but they greatly reduce the chance of failing due to drawdown breaches, which is the primary cause of challenge losses.

-

Resources4 years ago

Resources4 years agoWhy Companies Must Adopt Digital Documents

-

Resources3 years ago

Resources3 years agoA Guide to Pickleball: The Latest, Greatest Sport You Might Not Know, But Should!

-

Resources8 months ago

Resources8 months ago50 Best AI Free Tools in 2025 (Tried & Tested)

-

Guides2 years ago

Guides2 years agoGuest Posts: Everything You Should Know About Publishing It