Resources

How an AI-powered Credit Risk Decisioning Platform Reduces Defaults

Defaults are one of the biggest risks lenders face today. Global economic shifts, rising debt, and new fraud tactics all make lending more complex. This is where a modern credit risk decisioning platform makes the difference. Without it, traditional credit checks often miss key signals.

AI-powered credit risk decisioning platforms change the game. These systems combine advanced analytics with alternative data to give lenders a faster, more complete picture of applicants. The result: fewer defaults, better approvals, and stronger portfolios.

The limitations of traditional credit risk models

For decades, lenders relied on credit bureau reports and financial statements. While valuable, these sources are incomplete. A borrower with no history (also called a “thin file”) might look like a risk even if they pay bills on time.

Manual reviews also slow down lending. Risk teams can take hours or even days to reach a decision. By then, the borrower may have moved on to a competitor. Fraudsters also exploit these slow, rigid systems with stolen or fake identities.

This is where AI-powered decisioning platforms step in.

What AI-powered credit risk decisioning brings to the table

AI allows lenders to process thousands of applications in real time. Decisions that once took hours now happen in seconds. This speed reduces friction and gives borrowers a modern, digital-first experience.

Machine learning also improves risk detection. Algorithms scan for subtle anomalies, like sudden income changes or irregular application data, that human reviewers may overlook. Over time, the system learns and adapts, staying ahead of new fraud tactics.

The scalability is just as important. AI platforms can handle volume spikes, such as payday lending surges, without adding staff or losing accuracy.

Modern AI credit risk systems also go beyond speed and accuracy. With the rise of white box models and Explainable AI (XAI), lenders can now see the reasoning behind every approval or refusal.

Instead of a “black box” decision, the platform highlights which data points influenced the outcome. This transparency not only helps lenders make fairer decisions but also supports compliance with regulations that require clear explanations for declined applications.

The role of alternative data in reducing defaults

Alternative data refers to non-traditional information sources beyond credit bureau files. This includes utility payments, rent records, telecom data, and digital footprints. For lenders, these signals reveal far more about a person’s financial behavior than a simple score.

Imagine a young borrower with no credit card. Traditional scoring might reject them. However, alternative data shows that they pay their rent, phone bills, and utilities on time. For a lender, that’s a reliable customer who would otherwise be invisible.

On the other hand, alternative data can flag early risk signs. Repeated overdrafts, erratic phone usage, or irregular repayments show stress in a borrower’s financial life. Catching these signals early helps lenders prevent defaults before they escalate.

Behavioral and digital signals for better risk profiling

Every interaction leaves a digital trail. Behavioral and interaction data help lenders understand how borrowers engage with money and with platforms.

Some of the most useful signals include:

- Session length and typing speed – show if an application is genuine or automated.

- Device consistency – the same phone or IP builds trust, while sudden changes raise questions.

- Loan behavior – sudden credit line max-outs, irregular repayments, or unusual borrowing activity are red flags.

- Communication style – polite, consistent engagement often signals reliability.

Viewed together, these signals form a behavioral fingerprint. This fingerprint gives lenders a sharper and more accurate picture of borrower risk.

Benefits beyond default reduction

AI-powered platforms don’t just cut defaults. They also improve the borrower experience. Faster approvals mean less frustration, especially for digital-first customers who expect instant results.

Fewer false positives mean good applicants are less likely to be wrongly rejected. Fraud detection is also stronger, reducing losses from stolen identities or fake accounts.

These systems also support compliance. Explainable AI models allow lenders to meet regulations while keeping processes transparent. For fintechs, microfinance providers, and banks, this translates to a competitive advantage in a crowded market.

RiskSeal’s AI-powered credit risk solution

RiskSeal takes AI-powered decisioning a step further for lenders. The platform analyzes 400+ alternative data points per applicant and maintains an extensive database of past credit checks. It also includes built-in debt collection capabilities, helping lenders manage defaults at every stage.

Key features include:

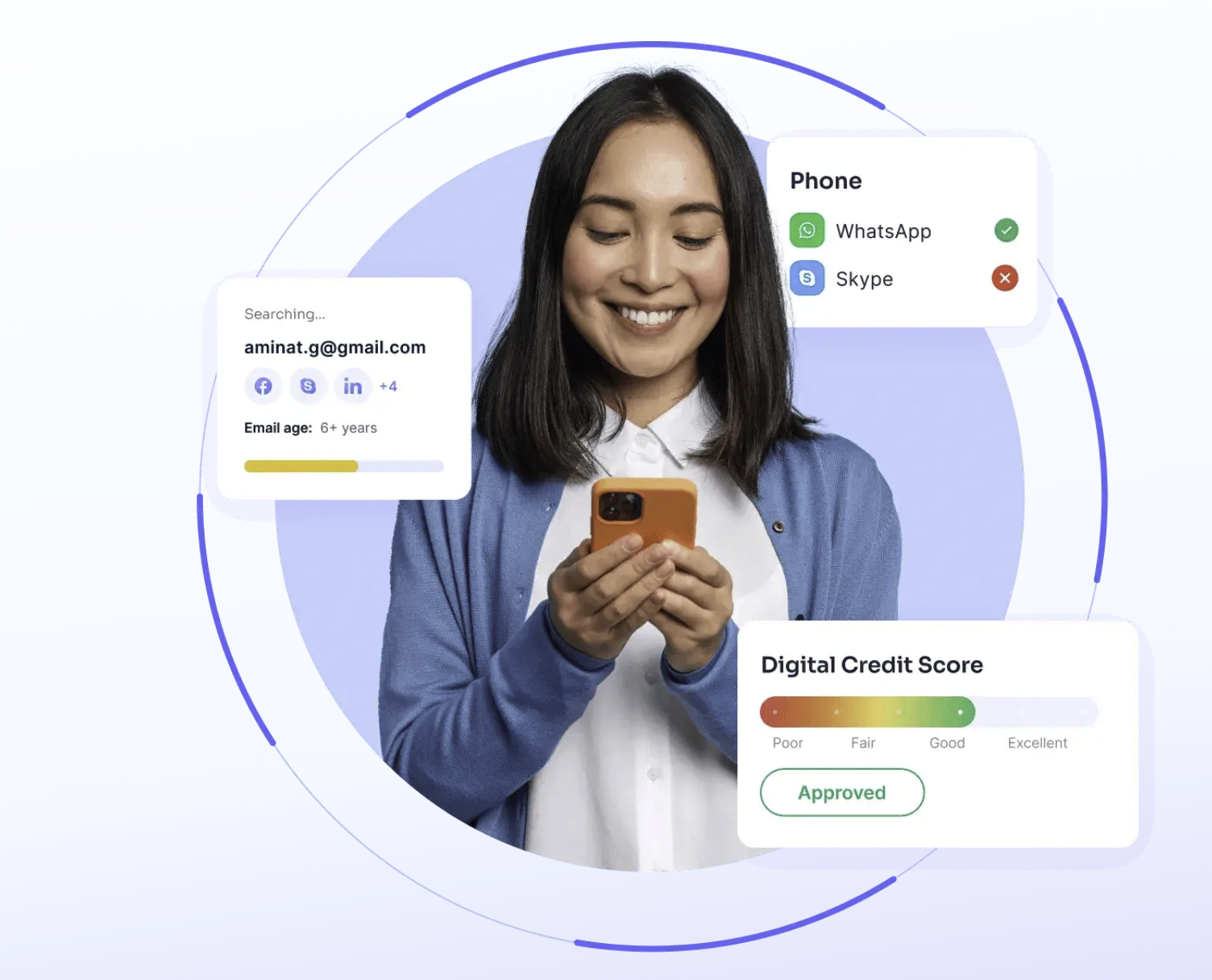

- Digital Credit Scoring – a ready-made score that turns complex data into a clear number.

- Digital Footprints – insights from online behavior, device use, and interactions.

- Data Enrichment – advanced analytics that add depth to applicant profiles.

- Email Lookup – identity and fraud risk signals from email metadata.

- Phone Number Lookup – stability, carrier, and fraud checks tied to mobile usage.

- IP Lookup – location consistency and VPN/proxy detection to flag suspicious activity.

With real-time scoring, digital footprint analysis, and behavioral signals, RiskSeal gives lenders a complete view of every borrower. The result: faster approvals, lower default rates, and expanded access to credit. Even for thin-file customers.

-

Resources4 years ago

Resources4 years agoWhy Companies Must Adopt Digital Documents

-

Resources3 years ago

Resources3 years agoA Guide to Pickleball: The Latest, Greatest Sport You Might Not Know, But Should!

-

Resources7 months ago

Resources7 months ago50 Best AI Free Tools in 2025 (Tried & Tested)

-

Guides2 years ago

Guides2 years agoGuest Posts: Everything You Should Know About Publishing It