Marketing

Easy WooCommerce Tax Setup for Canadian Startups in 2025

Launching a WooCommerce store as a Canadian startup is like jumping into a wild river—you’re pumped, but taxes can drag you under if you’re not ready. I found this out the hard way when my cousin’s new online shop got slapped with a $2,000 fine for a wonky GST setup. Getting your WooCommerce Canada tax setup right is a must to keep the CRA off your back and your customers smiling. This guide’s for startup founders hustling on WooCommerce, loaded with tips on ecommerce bookkeeping and accounting for ecommerce sales to crush it in 2025.

What’s the Deal with Canadian Taxes for WooCommerce?

Taxes in Canada are like a jigsaw puzzle—every province has its own piece. Mess it up, and you’re either overcharging customers or facing a CRA audit. Here’s the scoop:

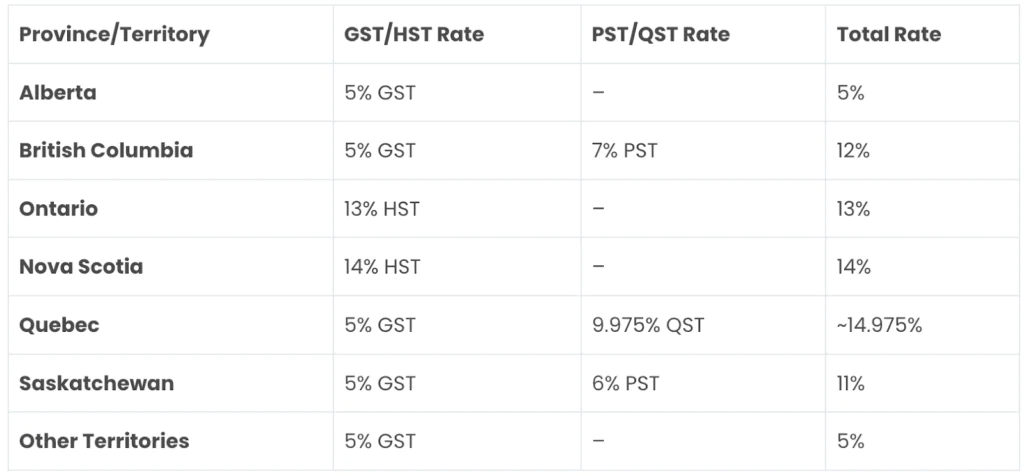

- GST: A 5% federal tax on stuff like hoodies or digital downloads, everywhere in Canada.

- HST: Mixes GST with provincial taxes in places like Ontario (13%) or Nova Scotia (14% in 2025, down from last year).

- QST: Quebec’s 9.975% tax, piled on top of GST, hitting around 14.975% total.

If your startup’s sales top $30,000 a year, you gotta register for GST/HST, and QST if you’re selling in Quebec.

Example: Picture selling a $50 scarf on your WooCommerce store. In Alberta, you tack on $2.50 GST (total $52.50). In Ontario, it’s $6.50 HST (total $56.50). In Quebec, it’s $2.50 GST plus $4.99 QST (total $57.49). Get these wrong, and you’re in trouble.

How to Nail Your WooCommerce Canada Tax Setup

Setting up GST, HST, and QST in WooCommerce isn’t rocket science, especially with ecommerce bookkeeping to keep you organized. Here’s how to do it, step by step:

- Flip the Tax Switch: Log into your WordPress dashboard and head to WooCommerce > Settings > General. Check “Enable taxes and tax calculations” and pick “exclusive” prices so taxes pop up at checkout. Save it. I forgot this once, and my cousin’s store showed no taxes—customers loved it, but the CRA didn’t.

- Add GST and HST Rates: Go to WooCommerce > Settings > Tax > Standard rates. Click “Insert row” and set GST: Country: CA, State: *, Rate: 5, Name: GST. For HST, add rows for provinces like Ontario (Country: CA, State: ON, Rate: 13, Name: HST) and Nova Scotia (14%). Check “Shipping” to tax delivery. A Shopify accountant from SAL Accounting can tweak this for WooCommerce.

- Tackle QST for Quebec: In Tax settings, add “QST” under “Additional tax classes.” Save, then click “QST rates.” Add: Country: CA, State: QC, Rate: 9.975, Name: QST, Priority: 2, Compound: Yes. If Quebec sales hit $30,000, register with Revenu Québec. Shopify accounting services can adapt for QST compliance.

Quick Trick: Test your setup with a $50 product in Alberta ($2.50 GST), Ontario ($6.50 HST), and Quebec ($2.50 GST + $4.99 QST).

Supercharge Your Setup with Tax Plugins

For startups with sales all over Canada or into the U.S., plugins can make WooCommerce Canada tax setup a breeze. WooCommerce’s built-in tools are fine for small shops, but plugins step it up for growing businesses.

- TaxJar: Auto-handles GST, HST, and QST with live rates. Starts at ~$19/month. Perfect for startups scaling fast.

- Avalara AvaTax: Calculates taxes and helps with filing. Runs ~$420/month, great for big players.

Example: A Vancouver startup I know used TaxJar to sort QST, saving them hours of manual work. Ecommerce accounting expert can hook you up with the right plugin for accounting for ecommerce sales.

Stay on the CRA’s Good Side with Ecommerce Bookkeeping

Nobody wants a CRA fine to tank their startup. Here’s how to keep your WooCommerce Canada tax setup legit:

- Update Rates Yearly: Tax rates shift—Nova Scotia’s HST dropped to 14% in 2025. Check RetailCouncil.org annually. A Shopify tax expert can keep your rates fresh.

- Set Shipping Zones: In WooCommerce > Settings > Shipping, create zones for each province to apply correct taxes. This nails GST, HST, and QST.

- Manage Exempt Items: Set a “Zero rate” tax class for tax-free goods like groceries. Ecommerce bookkeeping keeps these separate.

- Test Monthly: Run test orders with addresses in different provinces to spot errors. Bookkeeping services for small business catch mistakes early.

- Track Digital Sales: Tax digital downloads based on the customer’s address, including QST for Quebec.

Case Study: Mia, a Toronto startup founder, sold $20,000 in art prints on WooCommerce but overcharged $2,600 in HST to Ontario buyers. Customers bailed, and a CRA audit loomed. A Shopify tax accountant fixed her settings, added 13% HST for Ontario, and refunded the overcharges. Mia dodged a fine and kept her customers.

Make Taxes Pop at Checkout with Accounting for Ecommerce Sellers

Confusing taxes can make customers ditch their carts faster than you can say “GST.” A clear checkout builds trust and keeps your WooCommerce store startup-friendly. Here’s how:

- Show Taxes Clearly: In WooCommerce > Settings > Tax, pick “Excluding Tax” for shop and checkout prices. This shows GST ($5), HST ($13), or QST ($9.98) separately.

- Name Taxes Right: In the Tax tab, label rates “GST,” “HST,” or “QST” instead of “Tax.” It’s way less confusing.

- Add a Tax Breakdown: Use the Checkout Field Editor plugin from the WooCommerce Marketplace to add a field for GST/HST or QST IDs for B2B buyers.

- Test Your Checkout: Try a $50 item with addresses in Alberta ($52.50 with GST), Ontario ($56.50 with HST), and Quebec ($57.49 with GST + QST).

Quick Trick: A Shopify tax expert from SAL Accounting can fine-tune your checkout for WooCommerce, making taxes crystal clear.

Lean on SAL Accounting for E-commerce Tax Success

At SAL Accounting, we’re all about helping Canadian startups and e-commerce owners ace their WooCommerce Canada tax setup. We help businesses stay on the right side of taxes and accounting, so they can focus on growth. Whenever, wherever. Visit salaccounting.ca to check out our bookkeeping packages for small businesses and launch your startup with zero tax stress!

Email: tax@salaccounting.ca

Phone Number: (416) 848-8470

Location: 55 Village Centre Pl, Suite 734, Toronto, ON L4Z 1V9 | 330 Bay St, Unit 1401, Toronto, ON M5J 0B6

-

Resources4 years ago

Resources4 years agoWhy Companies Must Adopt Digital Documents

-

Resources3 years ago

Resources3 years agoA Guide to Pickleball: The Latest, Greatest Sport You Might Not Know, But Should!

-

Resources7 months ago

Resources7 months ago50 Best AI Free Tools in 2025 (Tried & Tested)

-

Guides2 years ago

Guides2 years agoGuest Posts: Everything You Should Know About Publishing It